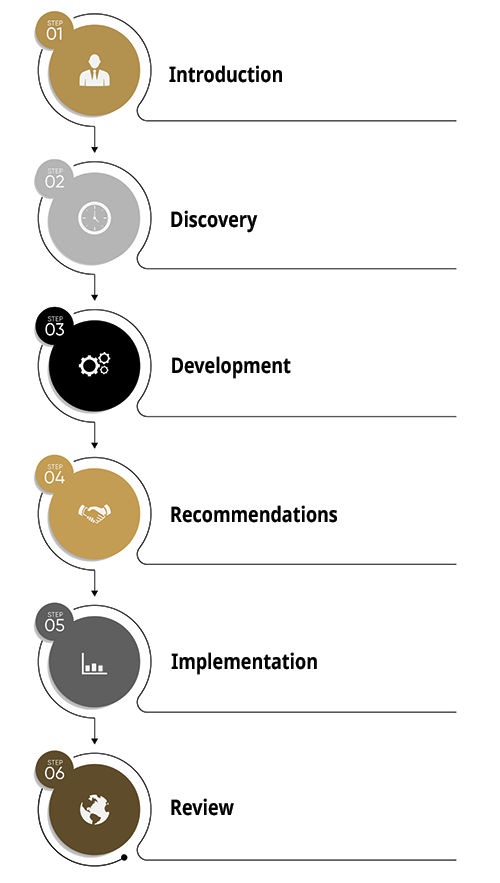

Financial Planning/Consulting Process

1. Establish the Relationship

The first step in the financial planning process is to simply introduce you to the services that your financial planner provides, to explain how these services are billed, and to develop a tentative timeline of when decisions and services will be complete.

2. Gather Data and Establish Goals

You and your financial planner will discuss your short and long term goals, and your planner will begin to compile the data necessary to help develop a plan for you.

3. Develop a Plan

Your financial planner will take the data that you have provided and offer recommendations that address your goals.

Cash Flow Accumulation

- Education

- Retirement

Risk Management

Asset Protection

Estate Planning

Wealth Preservation

Asset Distribution

Investments

Business Planning

4. Discuss Recommendations

Together, you and your financial planner will go over the recommendations to ensure that you understand them and feel confident that you can make informed decisions.

5. Implement

Once you’ve made decisions about which recommendations you would like to use, your financial planner may help you implement your plan, coordinating the whole process to include other professionals such as attorneys or CPAs if necessary.

6. Monitor and Review

You and your financial planner will decide on who will monitor progress towards your goals, meeting periodically to determine if any adjustments need to be made.